Get Instant Access to

Our Retirement Cheat Sheets

One-page guides with the

critical facts you need

From the Editors of the Retirement Income Blog

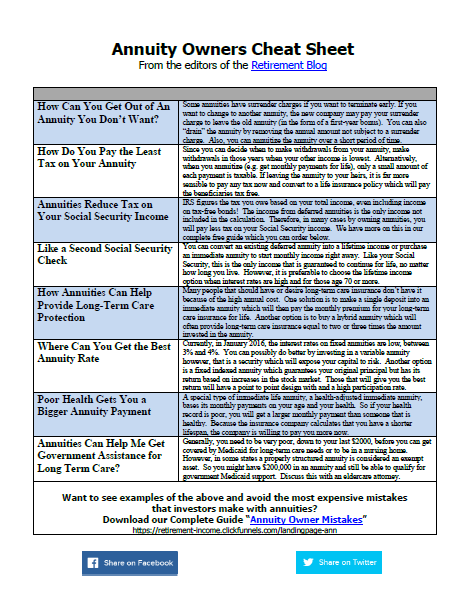

Millions of people buy annuities each year. And even more millions own them already. Unfortunately, a BIG portion of these people make errors when they purchase (there are 5 different types of annuities and people often buy the wrong type) and errors Then, people make errors as they own them such as withdrawing funds in a manner that costs extra taxes. The result? They earn far less they they could on their money and at worst, wind up paying expensive surrender fees to get out of an annuity after they realize they have made a bad choice.

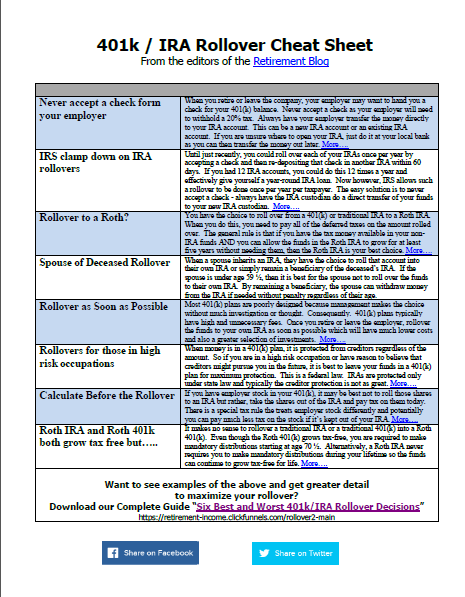

Here are eight mistakes to avoid when you move a 401k account or an IRA account. The IRS has set up a minefield of rules and you can easily trip over any of them. For example, if you move 401k funds one way, you must pay a 20% withholding tax. if you move 401k funds the right way, there is no withholding tax. There are a slew of these silly yet costly mistakes waiting for you. If you have 401k or IRA accounts you need to move, get this checklist and avoid extra taxes or IRA penalties from costly mistakes.

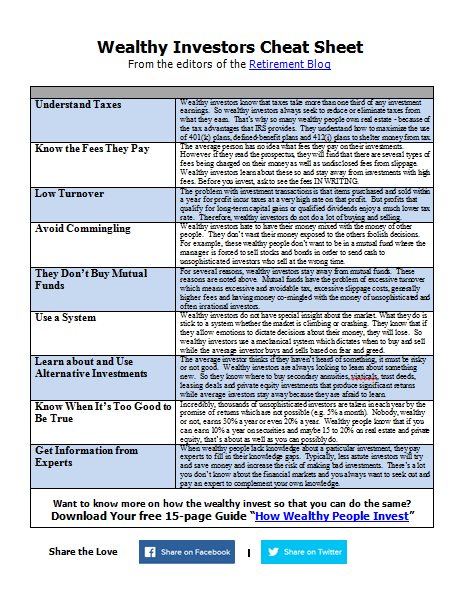

Wealthy investors invest differently than you do. In fact, we’ve identified nine things they do differently. For example, did you know that most wealthy investors do not use mutual funds? Get the checklist of nine investing habits that you want to have. You don’t need to be rich to adopt the same habits of the rich. In fact, to replicate their success, do as they do. Get the checklist and avoid the mistakes that small investors make month after month.

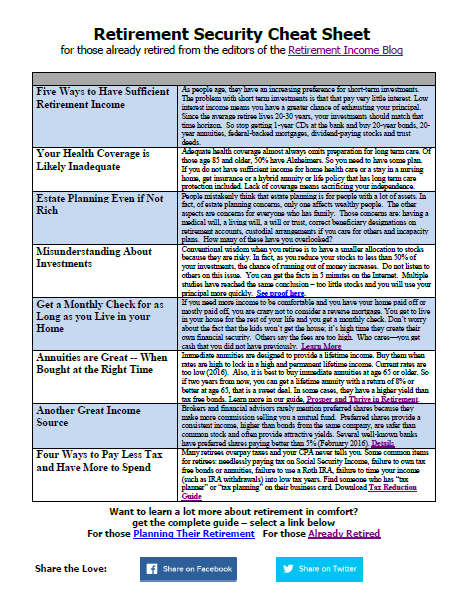

We’ve identified eight tasks to complete the day after you retire. Many people skip or overlook these tasks and the result is typically financial heartache for themselves or their family members. Most people would be glad to do these small tasks if somebody had told them to get them completed. But many people are simply ignorant and don’t realize that there are financial tasks in retirement that will help you have your best retirement and also avoid heartache for your family.

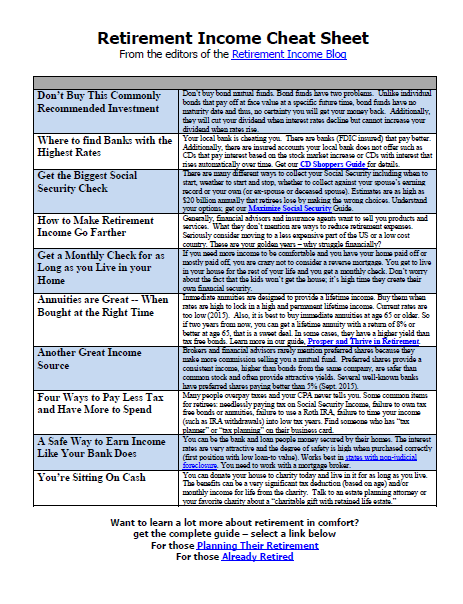

Here’s a list of 10 ways to get more income during retirement. Some of them, you will never hear about from your financial advisor. Why? Because he doesn’t offer them and if there is no sale for him to make, he will never mention them. Be well informed investor, know about all the opportunities for income and have more spendable income in retirement.

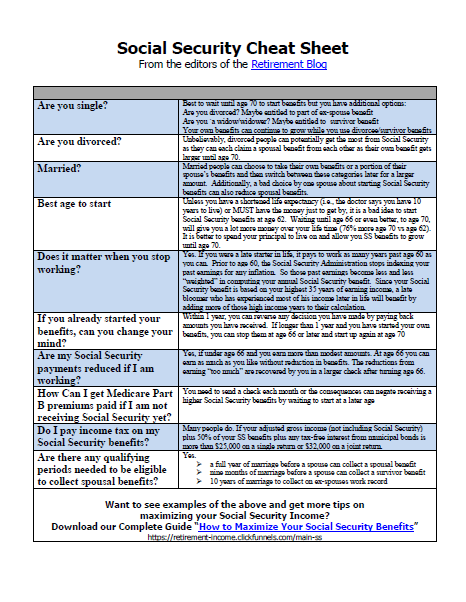

Did you know that there are 12 ways to claim your Social Security benefits? Make the wrong choice and you will get a smaller check for the rest of your life. Unfortunately, a government study shows that the people at the Social Security office, often provide incorrect or incomplete advice. Get all of the Social Security benefits do you and get your largest check after you read this checklist and know the questions to ask.

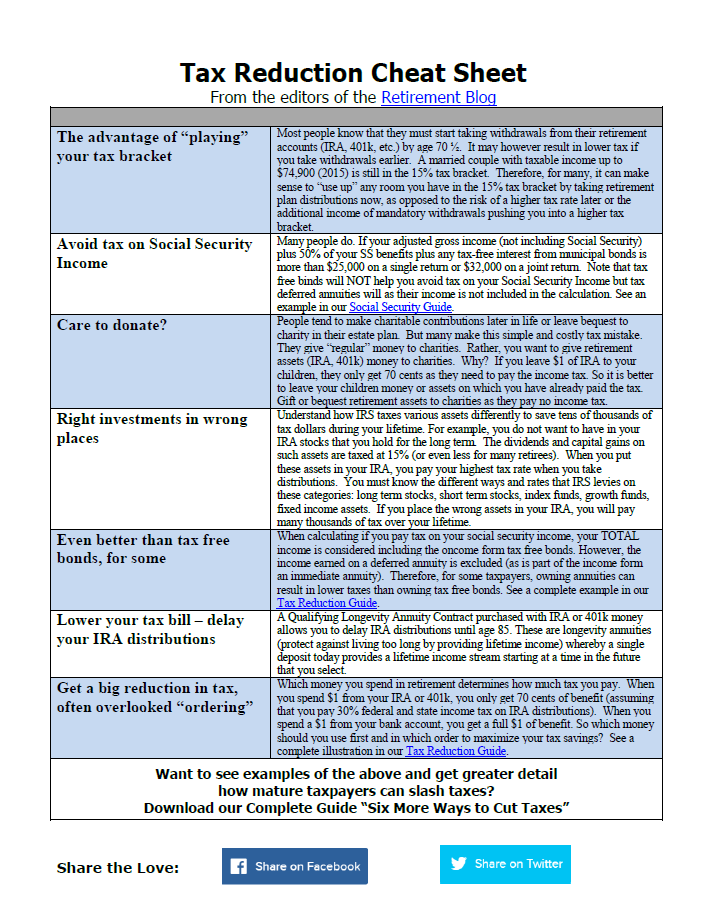

Here’s a surprise. There are six senior tax breaks that apply specifically to retirees. What’s surprising is that your accountant likely never mention them. These tax breaks allow almost everyone over the age of 62 to lower their tax Bill and have more retirement income. To know about these tax breaks so that you can ask your accountant, download your copy of the tax reduction checklist of six senior tax breaks.

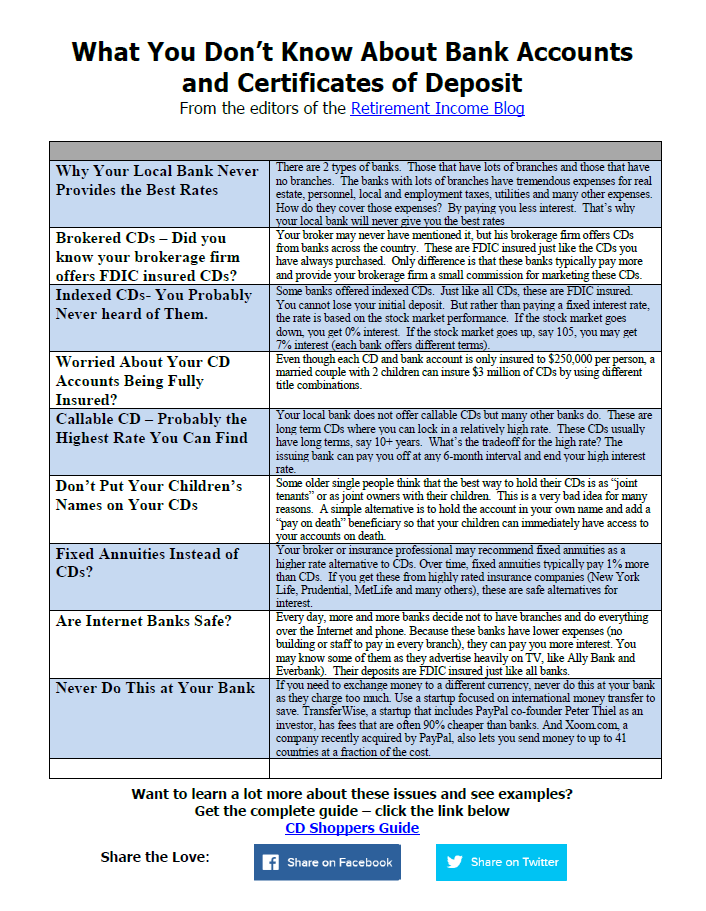

There’s something that your local bank doesn’t tell you. They don’t tell you how to make the most interest on your insured deposits. Have they ever told you about indexed CDs? Have they ever told you about brokered CDs? These are just two types of insured accounts that can help you earn more and accounts that your local bank will never mention to you. Also learn about a transaction you never want to make it your local bank because they always overcharge. Get your checklist on how to earn more on FDIC insured accounts.

Here is a life insurance guide specifically for people age 60+. The guide explains little-known methods to convert a life policy into income or sell it for a lump sum–more than your insurance company will give you. Also explained are ways to use life insurance you have not considered, such as using it to create equity when leaving indivisible assets to more than one heir.

What will you do when your health fails? When you need to cover those expenses not covered by Medicare: having someone to cook, clean, shop, drive, provide other assistance? Or maybe pay for a nursing home or assisted living? Will you be a burden on your family or will you have a plan in place. Learn what you don’t know about long-term care solutions.